We invest in quality companies with a positive impact

Sustainability is enabled by technology, not sufficiency

>200M

Assets under management6

Dedicated team members16

Years track record+6%

Annualized performance since 2007We are convinced that rising energy costs, scarcity of resources, and climate change are moving us toward a sustainable future. This development opens up attractive investment opportunities. We invest in companies with technologies that are actively shaping this transition.

The Team

The Carnot team is distinguished by experience in equity analysis and expertise in impact investing.

Our Impact Funds

Carnot Efficient Energy

The most environmentally friendly approach to the energy transition is to use existing energy more efficiently.The big trump cards of this strategy are that it can be realized with already established technologies and that it is cheaper than the alternatives.

- European quality stocks

- Solid outperformance since 2007

- Positive impact for energy transition

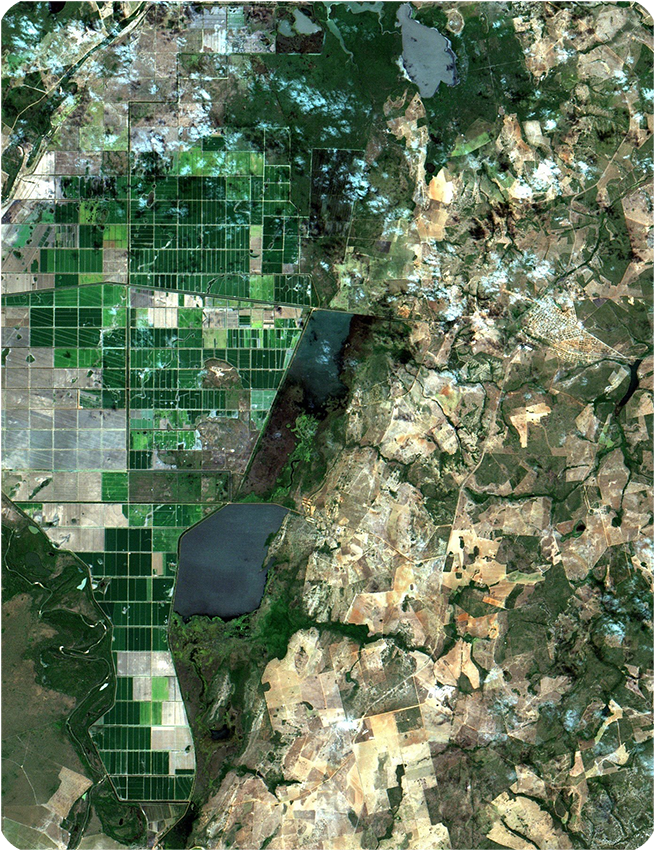

Carnot Efficient Resources

Today, natural resources are being used or depleted at a rate that cannot be sustained in the longer term. Technologies to counteract this trend exist and offer interesting investment opportunities.

- Global, liquid quality stocks

- Technologies for the circular economy

- Broadly diversified

Circular World Index

Reuse instead of throwing away. Mountains of waste and scarcity of resources make recycling essential.

- Actively managed index certificate

- Technologies around recycling

- Issued by Bank Vontobel

Our

Impact

The impact assessment is the result of a sound analysis that we make ourselves. Important criteria are the strategy of the company, the impact of the products in the world and the innovative strength of the company. We also consider an economic benefit of the products and a good profitability of the company as prerequisites for a positive impact to be sustainable.